Do inflation expectations matter? Yes, they do. Inflation expectations influence the behaviour of both people and firms. Would you prefer to buy a house today if you expect future inflation to be higher? Does it make sense to delay an investment decision if future inflation is expected to be lower? Workers bargain for a higher wage increase if they expect rising inflation. Firms are unlikely to set a high price if they perceive lower inflation in future. All things considered, expected inflation influences current wage negotiations, price setting and financial contracting for investment. Stated differently, inflation expectations are one of the main drivers of current inflation itself. Therefore, central banks worldwide pay close attention to the understanding of inflation expectations and implement appropriate monetary policies to keep inflation expectations well anchored. Anchoring means less variability of inflation expectations against shocks to inflation, from either the demand side or the supply side. Therefore, if inflation is well anchored, shocks will have a less persistent effect on actual inflation, thereby bringing credibility to central banks and the effectiveness of their monetary policies.

As inflation expectations are critically important for policymaking, they must be measured and monitored. But the problem is that they are not directly observed; they need to be estimated. There are mainly two sources of information on inflation expectations collected by the central banks and other agencies: survey-based and market-based. In the survey-based approach, respondents are asked what they perceive currently and expect in future regarding inflation. On the other hand, the market-based approach indirectly extracts inflation expectation information from financial market instruments. For example, the differential yields of ordinary and inflation-indexed government bonds of similar maturity provide some indication of inflation expectations. Market-based inflation expectations can be easily derived for countries such as the US and the UK. These countries have the deepest and most liquid markets for nominal and real return bonds that are issued at a wide range of maturity points. But for other countries, particularly India, estimating market-based inflation expectations is difficult because of the unavailability of data.

Surveys on inflation expectations consider three types of respondents: households, businesses and professionals. The Reserve Bank of India (RBI) captures the households' inflation expectations through a regular survey called the Inflation Expectations Survey of Households (IESH). This survey provides both qualitative and quantitative assessments of households' inflation expectations. RBI also conducts a regular Survey of Professional Forecasters (SPF) to gauge forecasts of major macroeconomic indicators, including inflation. The experience suggests that IESH consistently overestimates inflation by a wide margin, and it is hard to assess actual inflation on the basis of the expectations data. On the other hand, SPF mimics RBI’s inflation projection trajectory and thereby provides little additional information for the policymakers. The missing link in this bouquet of technical exercises was the firms’ inflation expectations. Against this background, the Business Inflation Expectations Survey (BIES) was introduced at the IIMA in May 2017.

BIES provides ways to examine the amount of slack in the economy by polling a panel of business leaders about their inflation expectations in the short and medium term. This monthly survey asks questions about year-ahead cost expectations and the factors influencing price changes, such as profit and sales levels. The survey is unique in that it goes straight to businesses - the price setters - rather than to consumers or households to understand their expectations of the price-level changes. A major advantage of BIES is that one can have a probabilistic assessment of inflation expectations and thus get a measure of uncertainty. It also provides an indirect assessment of the overall demand condition of the economy. Results of this survey are, therefore, useful in understanding the inflation expectations of businesses and complement other macro data required for policymaking. The BIES questionnaire was finalised on the basis of the detailed feedback received from the industry, academicians and policymakers. Firms are selected primarily from the manufacturing sector, and the results are based on the responses of roughly over 1,000 companies.

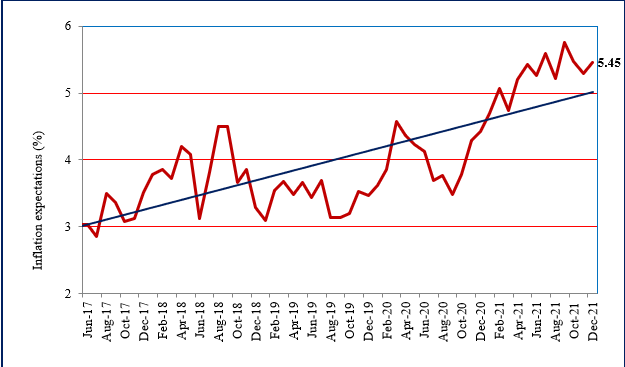

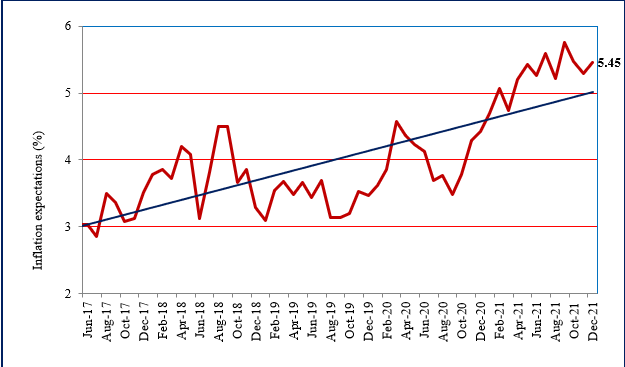

By design, BIES captures inflation expectations from the cost side, and hence, it has more correspondence with CPI core inflation. On average, the correlation between BIES inflation expectations and CPI core inflation is consistently running over 60%. The recent data release relating to December 2021 shows that one-year-ahead business inflation expectations have increased to 5.45% from 5.30% reported in November 2021 (Chart 1). The number of firms perceiving significant cost increases (over 6%) has remained high at around 57% during the last two rounds of the survey. Interestingly, the uncertainty of firms' inflation expectations has reduced sharply, implying increasing convergence in inflation perceptions. Although the business inflation expectations have been rising slowly since October 2020, they have remained below 6% so far - unique information providing a basis to support RBI's interest rate policymaking for inflation targeting. However, the trajectory of the past two years' inflation expectations indicates that inflation expectations have remained relatively unanchored. Firms' sales expectations in December 2021 have sharply dropped - the percentage of firms reporting "much less than normal" sales shot up to 36% from 29% reported in November 2021. This may be partly due to the recent surge of COVID-19/Omicron infections, indicating that the economy is still not out of trouble as far as consumption is concerned.

Chart 1

One-Year-Ahead Business Inflation Expectations (%)

Currently, in its 56th round, BIES has played an important role in policymaking by addressing an important data gap in the macroeconomy. The Monetary Policy Committee (MPC) members and other policymakers have referred to the survey results on numerous occasions. The monthly release of BIES features in the public discourse regularly. Going against the perceived wisdom, BIES was the first to highlight that the economy was heading towards increasing inflation when the entire country was witnessing a significant demand slowdown because of the stringent lockdown rules announced by the government. BIES is an example to support data and information-driven macro policymaking.

One-Year-Ahead Business Inflation Expectations (%)

About The Author

Prof. Abhiman Das

Professor Abhiman Das (abhiman@iima.ac.in) is the RBI Chair Professor in Finance and Economics in the Economics area.